The Bailiff Refused To Show His ID Or The Warrant Or Writ.

A bailiff who refuses to show evidence of his identity and authority to be on the property (or presents a counterfeit police-like ID card and badge) is no longer acting in the lawful execution of duty because he is in breach of Paragraph 26 of Schedule 12 of the Tribunals Courts and Enforcement Act 2007.

Bailiffs must show evidence of their enforcement power, such as a Warrant of Control, a High Court Wirt, or a Liability Order, and evidence of their identity if asked by the debtor or anyone in charge of the property.

If a bailiff refuses to present the Warrant or enforcement power, they are likely aware it is "defective", perhaps due to an incorrect address. The bailiff knows that showing the Warrant may expose the creditor to liability. In such cases, the debtor has the right to apply for the enforcement to be revoked and recover any controlled goods or money taken together with their legal expenses.

Bailiffs will refuse to show the Warrant when they clamp a vehicle after finding it on a highway using an ANPR camera.

Anyone affected by the bailiff’s actions can claim damages due to this breach under Paragraph 66 of Schedule 12 of the Tribunals Courts and Enforcement Act 2007.

If a bailiff flashes a police-like warrant card and badge instead of his official certificate, he commits an offence under section 90 of the Police Act 1996.

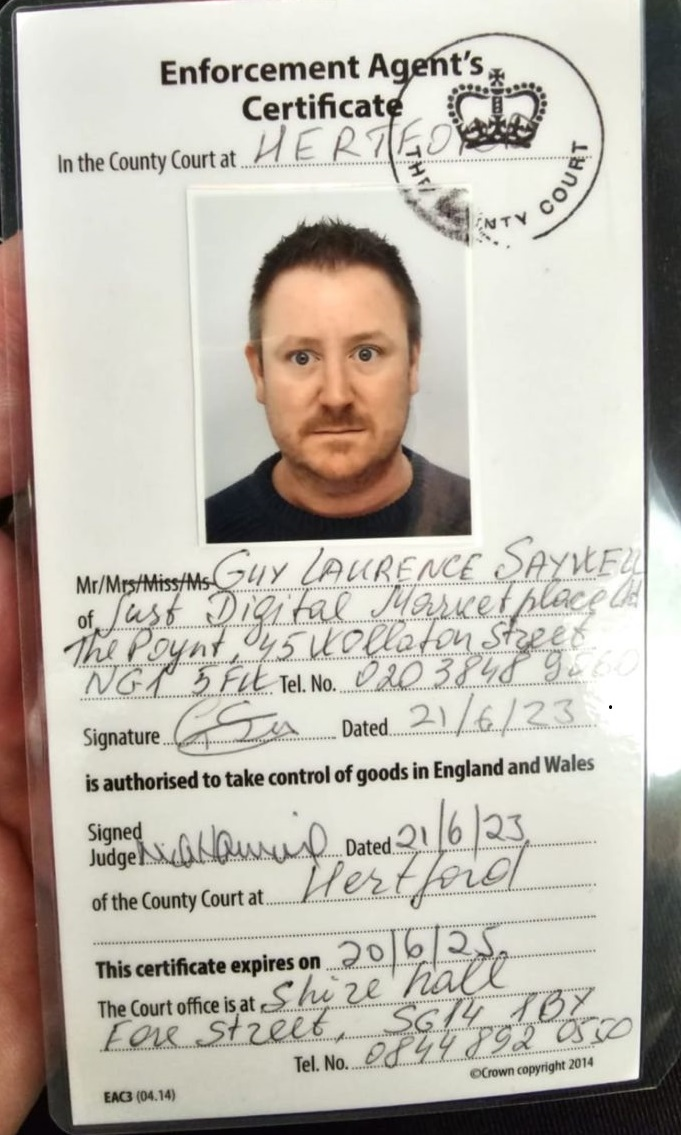

A bailiff's official identification is his enforcement certificate, a white laminate card measuring two inches by six inches displaying his mugshot and signed by a judge. You have a right to photograph it to verify his identity.

Geuine Enforcement Agent Certificate

Genuine Police Badge And Warrant Card

Fake! - Bailiff flashing A Police-like Badge And Warrant Card

Fake! - Bailiff Carrying A Police-like Badge And Warrant Card

Fake! - Bailiff flashing a fake Police-like Warrant Card

Template: Issue a formal request to the bailiff, demanding that he provides evidence of his valid enforcement certificate, along with a copy of the enforcement power that applies to the address he attended.